Volatility gets a bum rap in the financial services industry. For the average investor, it’s synonymous with risk and you’ll often see the two terms used interchangeably. Nor is volatility’s reputation entirely unfounded. Certainly over a short time horizon, a tumultuous market can have real consequences if you need to buy or sell an investment. In that case, what might be merely volatile for another investor is downright risky for you. However, volatility isn’t an effective measure of long-term risk.

“Wisdom” regarding volatility

Commonly represented by standard deviation in finance, volatility is a statistical measure of up and down price fluctuations over time. Investments with rapid, dramatic price swings are considered highly volatile. Those with consistent prices are considered to have low volatility. The formula for standard deviation treats all volatility the same. It tells you how much results have deviated from their historical average, whether above or below it. Thus, an investment with nothing but positive returns can nevertheless have high volatility if those results have varied from slightly positive to massively so. Put simply, volatility measures how a stock trades and not necessarily how much business risk it holds.

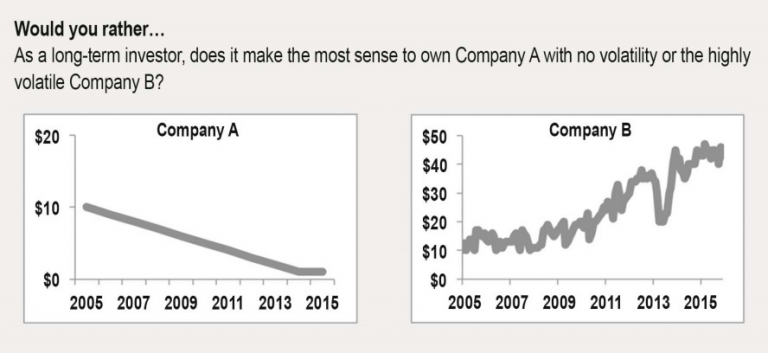

Consider the following example. Company A isn’t volatile but provides a false sense of security as over time, its stock price has steadily declined to near zero. On the other hand, Company B – while chock full of short-term price variability (uncertainty) – is trending higher in the long run.

The heart of the matter

What’s at the root of these up and down price movements anyway? Volatility can be a sign of market participants acting emotionally rather than rationally. History proves that in the short term, stock markets don’t operate so much on mathematical principles as they do on behavioural psychology. The tech bubble is an obvious example of emotions overtaking investors’ common sense. In recent memory, escalating sovereign debt crisis unnerved markets the world over and sent volatility soaring once again.

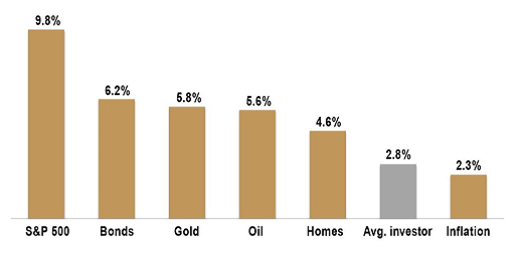

It can be a vicious circle. Investors react to short-term “noise” from the likes of salacious newspaper headlines and opinionated industry pundits, and buy or sell stocks on emotion. Investors then react to those market movements, creating – you guessed it – greater volatility. As illustrated in the example below, far too often the greatest risk investors face isn’t from external forces but rather their own harmful behaviour.

Investors behaving badly

Those rattled by volatility who shift in and out of the market tend to have poor timing. This graph shows how the average investor has historically received a fraction of index-based returns from buying and selling stocks at inopportune times.

20-year annualized returns by asset class

(1994 to 2014)

Source: JP Morgan, Bloomberg. Bonds: Barclays Capital U.S. Aggregate Bond Index; Oil: Bloomberg WTI Cushing Crude; Homes: S&P/Case Schiller U.S. Home Price Index; Inflation: U.S. Consumer Price Index; Investor returns: Calculated using Dalbar fund flow information. All returns annualized and in US$.

A different definition of risk

Lower volatility doesn’t necessarily make an investment safer. Likewise, an investment can be volatile without being risky. That’s why seasoned investors don’t view volatility as risk. Rather, risk should be viewed as the possibility for a permanent loss of capital. In other words, a stock goes down in price and stays down for a long time or even forever. Historically, such an event has coincided with times of consensus thinking. For example, in the 1980s, investors believed that the Japanese management style was superior. Copying it was in vogue because the Japanese knew how to run businesses. If you invested in line with this theory and bought into the Nikkei Index, you’d still be down today.

Fast forward to the 1990s, when the crowd said that emerging economies like Mexico would always grow the swiftest. That changed mid-decade with the 1994 Tequila Crisis. By 1998, emerging markets from Russia to Southeast Asia had virtually collapsed.

The dot-com bubble that came next saw investors latch on to the false promise of sustained explosive growth from internet-based companies. These unrealistic expectations fueled “irrational exuberance” in the market. When the bubble burst, billions of dollars simply evaporated along with it.

And not too long ago investors lost vast sums in the 2008 financial crisis in part because they mistakenly believed that real estate could only go up in value because everyone said it would.

Each of these instances resulted in a permanent loss of capital as those who followed consensus haven’t yet recouped their money. Accordingly, it’s more prudent to adopt an old-fashioned view of risk that asks, “How much money can I lose and what’s the probability of that loss?”

Real risk has to do with factors that can go wrong with the underlying fundamentals of an investment. For that reason, thoroughly understanding a business is a far better form of risk control than focusing on a stock’s past price behaviour.

Say 100 people are asked to price a new pickup truck. Most will accurately peg the truck’s value at between $25,000 and $45,000. Now, say those 100 people are offered the truck for $200. Surely all will accept and lose no sleep thinking they overpaid.

Imagine the same 100 people are asked whether a publicly traded company is worth $50, $100 or $300 a share. No doubt few will have any idea of its worth. What if that company’s share price falls on negative macroeconomic headlines that have no impact on the business’s underlying value? Most likely almost everyone will rush to sell their shares. When you don’t know the value of what you own, there’s almost nothing as uncomfortable as watching its price plummet.

That’s why its investors’ job to know a business’s value so they can take advantage of those who don’t. It requires staying focused on company-specific risk such as increased competition and margin contraction, management competence and the valuation of a business relative to its true potential. Following this approach puts investors in a better position to make good decisions in the face of volatility.

Harnessing volatility

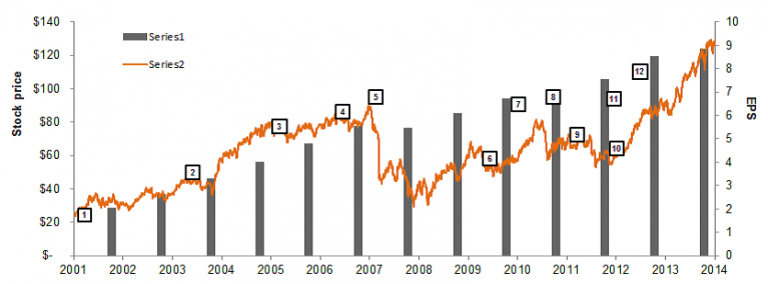

Now for a real-world example of how share price movements in the short term can bear little resemblance to a business’s long-term operations. The graph that follows compares the annual earnings of a dominant U.S. health insurer to the company’s stock gyrations over the same timeframe. Notice that while earnings consistently increased, the share price was nevertheless quite volatile. However, that volatility was rarely due to factors in the underlying business. As Ben Graham liked to say, “In the short run the market is a voting machine but in the long run it’s a weighing machine.” In time, the divergence between share price and business value tends to disappear as investors come to recognize a company’s true worth. What happens in the short term is anyone’s guess. But knowing that you own a piece of a business – and not just a stock – should keep your investments on track and provide peace of mind during volatile periods.

Stock price volatility in action

Source: Bloomberg LP. As at December 31, 2014.

- Company acquires a competitor for an undisclosed amount.

- Company increases stock repurchase program to authorize future purchases.

- Insurance cancellation scandal widens and company sued for illegally denying coverage.

- CFO fired.

- Company announces strong 2008 outlook. Its leading market position is expected to continue generating good growth and enhanced value.

- U.S. health insurers “moving towards an oligopoly.”

- Stock repurchase approved, but investors prefer increased dividend.

- Macroeconomic fears spread about the European debt crisis and concerns over France’s AAA rating.

- Supreme Court upholds Obamacare as constitutional.

- Company announces plans to replace its CEO.

- New CEO named.

- Company acquired.

To recap, volatility shouldn’t be viewed as risk. It may feel like it but in reality, it doesn’t represent risk in the true sense. True risk is the opportunity for a permanent loss of capital.

Written by Rebecca Jan in collaboration with Tye Bousada, Sayuri Childs and Geoff MacDonald.

The above company was selected for illustrative purposes and is not intended to provide investment advice. EdgePoint Investment Group may be buying or selling positions in the above security. Commissions, trailing commissions, management fees and expenses may all be associated with mutual fund investments. Please read the prospectus before investing. Copies are available from your financial advisor or at www.edgepointwealth.com. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. This is not an offer to purchase. Mutual funds can only be purchased through a registered dealer and are available only in those jurisdictions where they may be lawfully offered for sale. This document is not intended to provide legal, accounting, tax or specific investment advice. Information contained in this document was obtained from sources believed to be reliable; however, EdgePoint does not assume any