By Andrew Pastor, portfolio manager

In the 1930s, Winston Churchill had left politics and was teaching a class at Cambridge University. He started a lecture with the following question, “What part of the human body expands to 12 times its normal size when subjected to external stimulation?” The class gasped, it was the 30s after all!

Churchill pointed to a young woman in the class, “What’s the answer?”

Blushing, the woman replied, “Obviously it’s the male sex organ.”

“Wrong! Who knows the correct answer?” asked Churchill.

Another student answered, “It’s the pupil of the human eye which expands 12 times when exposed to darkness.”

“Of course!” replied Churchill. He then turned to the first student and said, “Young lady, I have three things to say to you. First, you didn’t do your homework. Second, you have a dirty mind. And third, you are doomed to a life of excessive expectationsi.”

In this commentary I want to discuss investor expectations. If you’re reading this there’s a good chance you believe the future will be similar to the recent past. If that’s the case you’re setting yourself up for disappointment.

We believe that over the next decade equity returns will likely be lower, and the ride not as smooth.

A rosy future

Schroders recently interviewed 22,000 investors in thirty countriesii. According to the study, the average investor said that they expect their overall portfolio to return 10.2% per year over the next five years. If we assume that the average investor holds a mix of 70% equities and 30% bonds this would suggest that investors are expecting a stock market return of 13%/yeariii. (Remember this number as we’ll be referring to it later).

Why are investor expectations so high? It probably has something to do with their experience over the past five years. Here’s a list of stock markets and their annual returns since 2013.

| Index | Annualized total return in local currency (12/31/12 to 12/31/17) |

|---|---|

| NASDAQ Composite Index | 19.49% |

| The Nikkei 225 Index | 19.06% |

| S&P 500 Index | 15.77% |

| The CAC 40 Index | 11.42% |

| Deutsche Boerse AG German Stock Index | 11.15% |

| Shanghai Composite Index | 10.43% |

| S&P/TSX Composite Index | 8.62% |

Source: Bloomberg LP.

The past five years have been favourable for investors. Prior to this period, investors were still fearful about the future and valuations were low. Today investor sentiment has improved resulting in higher valuations which has boosted returns.

To predict is human

When people make predictions about the future they often draw from their recent experience and extrapolate it into the future. Behavioural economists call this the recency bias. It creeps into our daily lives all the time.

Think about your favourite team. At the beginning of the season it gets off to a strong start. They win the first three games and you’re already booking the day off work for their celebratory parade. You forget (or at least try to!) that the regular season alone is 82 games long and they haven’t won a Stanley Cup since 1967!

When it comes to making investment forecasts, our recent experience also tells us little about the future. As I will explain later, the experience of investors over the past five years is an aberration not the norm.

The super-forecasters

In previous commentaries we’ve discussed the follies of forecasting. We explained why financial experts are almost always wrong about the direction of the stock market, interest rates or commodities.

But there’s a small group of forecasters that has consistently been able to make more accurate predictions. A Wharton professor named Phil Tetlock wrote a book called Superforecasting: The Art and Science of Prediction which studied the behaviours of these super-forecasters.

What can we learn from Tetlock’s work? Instead of making predictions based upon their recent experience (the inside view) the super-forecasters use history as a guide (the outside view). They ask whether there are similar situations in the past that may provide insight into what may happen in the future. The idea being that what’s happened over long periods is likely to be more relevant than what’s happened most recently.

Let me illustrate the concept with an example.

Big Brown

One of the most coveted prizes in sports is the Triple Crown. A horse must win the Kentucky Derby, the Preakness and the Belmont over a five-week period.

In 2008 Big Brown was the horse to beat. He’d won the first two legs of the Triple Crown by a significant margin. Shortly before the final race his main competitor, Casino Drive, had to drop out due to injury. Horse racing experts predicted that Big Brown was going to win by a landslide. When the bets were placed Big Brown had a 75% probability of winning the Triple Crown.

What happened on race day? He finished dead last.

After the race was over, questions emerged. Was Big Brown injured? Did the jockey change the strategy for race day? Perhaps the horse was fatigued from the grueling race schedule?

The truth is that Big Brown’s defeat shouldn’t have been a surprise to anyone. It’s a classic case of people forecasting based upon their recent memory (the inside view) and ignoring history (the outside view).

The inside view was that Big Brown was undefeated, he’d won the first two races by a wide margin and the competition was weak.

The outside view asked one important question: What happened in the past when a horse won the first two legs of the Triple Crown?

It turns out that from 1950 to 2008 there were 20 horses that had won the first two races. Only three (15%) went on to win the Triple Crowniv.

Big Brown was always a long shot to win. Even the professionals fell victim to recency bias in predicting the future.

Fighting the last war

A classic example of “inside view” behaviour can be observed through investor expectations over time. History has shown that investors consistently look in the rear view mirror rather than out the windshield. After the market has had a strong run investors expect the good times to continue forever.

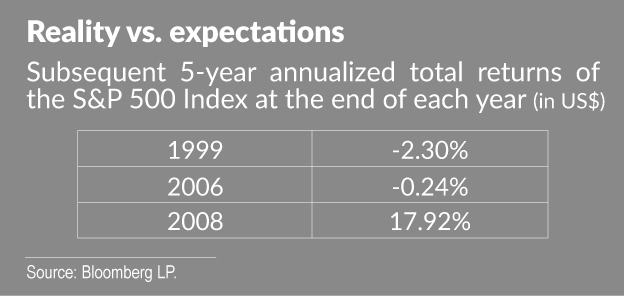

1999 is a good example. During the tech bubble investors were asked what they expected stock markets to do over the next 10 years. The least experienced investors (those who’d invested for less than five years) expected annual returns of 22.6%. Even the most experienced investors (those who’d invested for more than 20 years) were expecting annual returns of 12.9%. Not surprisingly the returns over the next decade were subpar and investors were left disappointedv.

Conversely, following a market correction, investors reset their expectations and are more apt to believe stocks will have low returns forever. Here’s a look at how investors behaved during the last downturn.

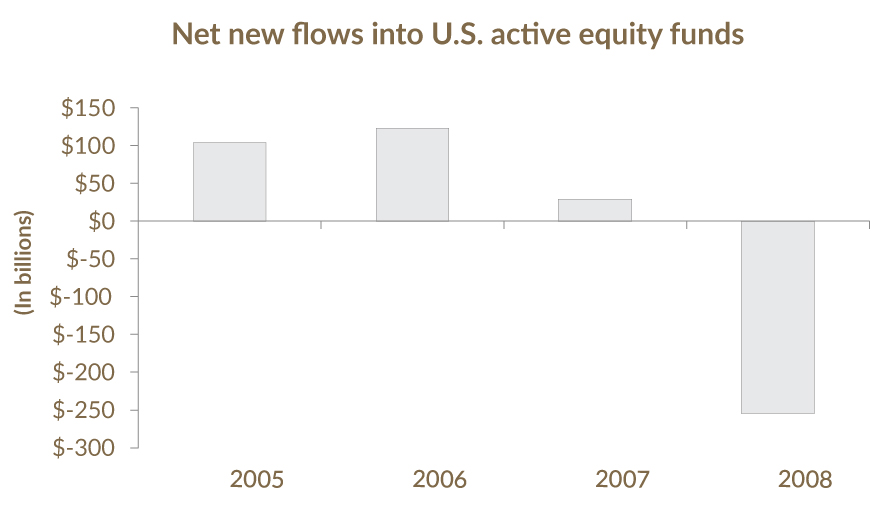

In the years leading up to the financial crisis investors piled into stocks. From 2005-2007, U.S. investors put $256 billion into equity funds. In 2008, investors pulled almost all of it out ($254 billion) in a single year, cashing out their investments at the bottom of the marketvi.

Where are we today? After nine years of rising stock prices, investors have very ambitious expectations for the future.

The outside view

Let’s take what we learned from the super-forecasters and apply it to the stock market. If we want to set reasonable expectations about the future we should start by looking at how the stock market has performed over long periods. The U.S. market has the longest history so it can be used as a proxy for equity returns.

Since 1928, the average annual total return of U.S. stocks is 9.4%vii. Let’s call this the base rate. If history is a reasonable guide, investors should expect a similar return.

Over the long term, the stock market can’t outpace the growth in earnings and dividends of the businesses that make up the market. However, in the short term the market can fluctuate wildly for a multitude of reasons. When the returns of the market no longer reflect the growth of the underlying businesses within it, the market will correct itself. Higher returns eventually lead to lower returns in subsequent periods and vice-versa.

Over the past five years, the stock market has risen much faster than corporate earnings. Since 2013, approximately 2/3 of the S&P 500 Indexviii returns have come from multiple expansion not earnings growth. The market can’t continue to rely on multiple expansion forever.

It’s impossible to predict the short-term movements of markets. But we would probably all agree that we’re closer to the top of the cycle than the bottom. Equity valuations are higher than they’ve been since we started the firm in 2008. As such, annual total returns are more likely to be lower than their long-term average of 9.4% than above it.

Another way to think about investor expectations is to invert the situation. If you want to assume that the market will provide annual returns of 13% you need to make certain assumptions. Perhaps you think that the economy will grow faster than in the past? Maybe interest rates will go lower? Or you believe the P/E multiple will continue to expand?

While all of these are possibilities, they’re also unlikely. Economic growth over the past decade has been the second slowest period since the Great Depression. Interest rates might stay lower for longer but they’re already approaching zero. Valuations can always climb higher but they’re at the upper end of where they’ve been historically.

Where does that leave us? Over the next few years the market might continue to roar ahead. But it’s hard to make the case that equity returns over the next decade will be as strong as they’ve been in the recent past.

A bumpy ride

Up until now we’ve focused on stock market returns. The other part of the investor experience is volatility – how smooth or bumpy the ride is. At the same time that stock market returns have been pleasing, volatility has been unusually low.

Compared to other asset classes equities have proven to be one of the best ways to build long-term wealth. But the ride has never been smooth. Stock prices are quoted daily which means that investors’ emotions are constantly tested. This is the trade-off you make as an equity investor – superior returns in exchange for a bumpier ride.

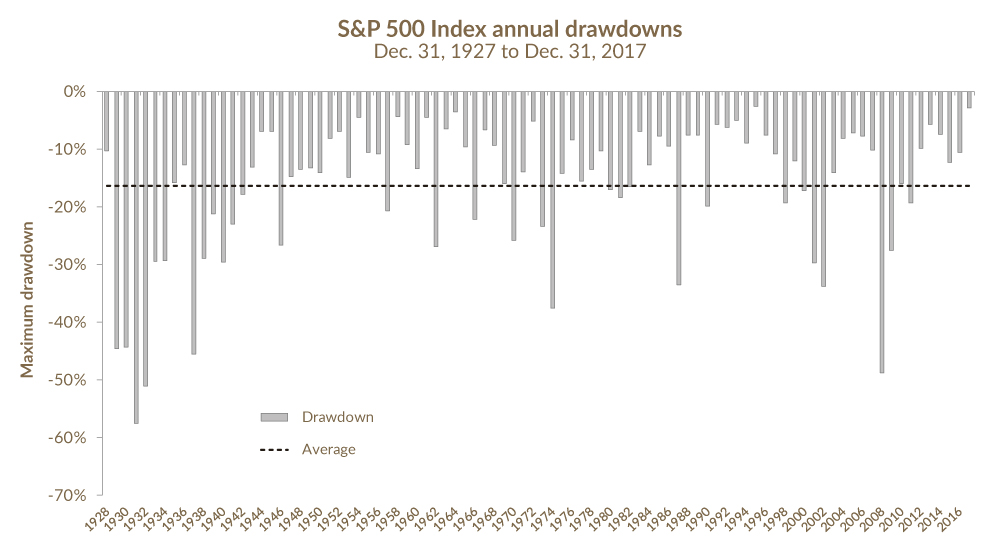

What is a normal level of volatility? A simple way to measure volatility is to look at the annual drawdown. This captures the peak-to-trough decline of the market in any calendar year. Since 1928 the average annual drawdown is 16%ix. This means that in a typical year you should expect your stocks to move 16% from their highest point to lowest point. This is normal.

Over the past five years the average annual drawdown was only 8%x. In fact, the annual drawdown has been under 10% in each of the past five years. 2017 was an extreme example because for the first time on record, the S&P 500 Index delivered a positive total return in each and every month.

While volatility might be temporarily hiding, it hasn’t gone away. Going forward, investors should be prepared for the calm waters of today to inevitably be replaced by rougher seas.

Source: Bloomberg LP, price returns in US$.

We’re not the market

The discussion up to this point has been focused on return expectations for the overall market. As you know EdgePoint doesn’t own the market. We own a small collection of businesses where we have a proprietary insight. Perhaps we’re immune to the headwinds that other investors face?

The reality is that our investment opportunity set is less attractive than it was five years ago. When we buy a business today we need to make more aggressive assumptions about the company’s future growth and profitability.

For example, in 2012 we invested in Drew Industries, a supplier of components for recreational vehicles (RVs). The RV industry took a significant hit following the financial crisis with annual shipments down to 286,000. Because of that, we were able to buy the business at a 7% free cash flow yield (translation: our first year return would be 7% before any growth) and we would get any recovery in the RV market for free.

Today, Drew is trading at a 4% free cash flow yield and annual RV shipments are over 500,000, 30% higher than the previous cycle peak. Compared to 2012, the starting valuation is higher and growth prospects more muted. Drew might continue to be a good investment, though we no longer own it, but investors need to be more creative with their assumptions for the idea to play out.

Our promise to you

If we can’t promise that equity returns will be as good as they have been in the recent past what can you expect from us? Here’s a list of things that we can promise you:

- We’ll operate in a narrow emotional band

- We’ll own businesses that can be bigger in the future and not pay for that growth

- We’ll try to capitalize on other people’s mistakes during periods of volatility

- We’ll stick to our investment approach through good times and bad

- We’ll treat your capital as if it’s our own, because it is. We’ve invested $160 million of our own money alongside you

(as at December 31, 2016)

The glass is half full

If you’re still reading this commentary you might be feeling pessimistic about the future. You shouldn’t be.

Investors have four primary ways of saving over the long term – cash, fixed income, real estate and equities. Compared to the other asset classes we believe equities are the most attractive option. Inflation eats away at your cash, bond yields aren’t sufficient to offset their risk and Canadian real estate is more expensive than at any other time in history.

We’ve never been ones to sing the praises of the stock market. We own a concentrated portfolio of growing businesses where we have a variant view. The environment might be more difficult today but we continue to find many new equity ideas: 15 in our Global Portfolio and 10 in our Canadian Portfolioxi. If our proprietary insights play out as we expect, our portfolios should deliver higher returns than the overall market.

Our investment approach has built wealth over multiple decades and across various cycles. We continue to expect that our long-term returns will be pleasing.

Just don’t make the same mistake as Churchill’s student or you’ll be doomed to a life of excessive expectations!

- An apocryphal tale taken from Barton Biggs, Hedgehogging (Chichester, U.K.: John Wiley and Sons Ltd., 2008).

- http://www.schroders.com/en/sysglobalassets/digital/insights/2017/pdf/g…. Total investment portfolio returns: we’re assuming this is the return expectations of stocks and bonds in a portfolio.

- Assuming bonds return 3%.

- https://www.horseracingnation.com/content/triple_crown_winners#.

- http://fortune.com/1999/11/22/warren-buffett-on-stock-market/.

- 2017 Investment Company Fact Book – www.icifactbook.org. Net new flow is the dollar value of new sales minus redemptions combined with net exchanges. Data for funds that invest primarily in other mutual funds were excluded from the series.

- Source: Bloomberg LP, 12/31/1927 to 12/31/2017, total returns in US$.

- Source: Bloomberg LP, 12/31/2012 to 12/31/2017, price returns in US$.

- Source: Bloomberg LP, price return, 12/31/1927 to 12/31/2017, in US$.

- Source: Ibid.

- Names purchased in the Portfolios during 2017. Global names purchased in the Canadian Portfolio are excluded.